Countdown to Change

On 19 January 2026, crucial regulatory change will herald a new era for UK capital markets as the amended Public Offers and Admissions to Trading Regulations (POATRs) remove long-standing structural barriers and transform primary market access for a broad retail investor base.

For wealth managers, investment platforms, brokers and fintechs, this presents a compelling opportunity to deliver a wider suite of investment products, deliver a richer client experience and drive stronger commercial outcomes.

For issuers and their advisers, the reforms significantly widen the pool of available capital, delivering value not only at the point of transaction but also in the aftermarket. The benefits of productive primary capital are well understood, but greater liquidity and price discovery in the secondary market can also help lower funding costs.

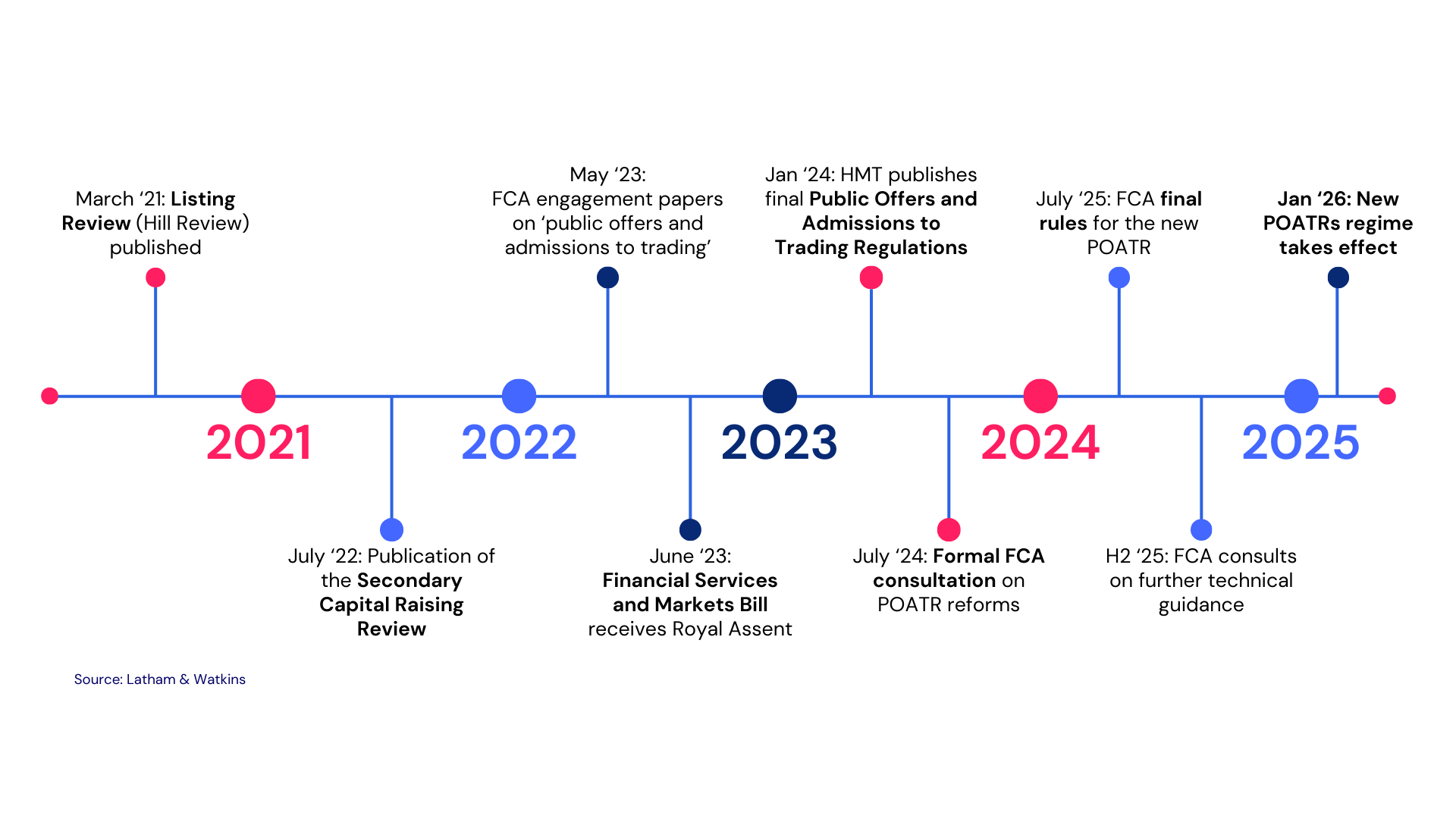

Highlighting the Regulatory Reforms

These bold reforms represent some of the most significant updates to the UK capital markets in decades and explicitly target a meaningful increase in retail investor participation.

Key Changes

| Asset Class | Feature | Current Regime | From Jan 2026 | Consequence |

|---|---|---|---|---|

| Equity | Cap on ‘Exempt’ Offers | ’Small Offer’ exemption, up to €8m retail allocation on undocumented deals | Public companies can issue up to 75% of existing shares, effectively removing the cap | Significantly greater allocation to retail without the cost and complexity of a prospectus |

| Debt | Disclosure | Dual - separate documentation required for retail and institutional offers | Single, harmonised prospectus rules for both institutional and retail investors | Individual investor participation to significantly increase given availability of lower denomination bonds |

| Equity | IPO prospectus availability | Six working days | Three working days | Retail inclusion in IPOs to become the default as execution risk for issuer reduced |

| Equity | Forward-Looking Statement Liability | Forward-looking statements carry high liability risk | Introduction of Protected Forward-Looking Statements (PFLS) | Improvement in the quality of disclosure for retail investors |

| General | Listing Application Process | Separate listing application for each subsequent issuance | Single application for a class of securities; subsequent issuances automatically listed | Significantly streamlines and speeds up secondary capital raises |

These critical changes align with the Hill Review, the Secondary Capital Raising Review, and Mansion House Reforms with the intention of building more dynamic, inclusive, and resilient UK capital markets.

The Case for Meaningful Retail Inclusion

By failing to effectively engage retail investors, the UK is overlooking a multi-billion-pound pool of capital that could otherwise be deployed to facilitate growth.

Since 2005, less than 5% of UK IPOs have included a retail offer and access to corporate bonds and secondary equity issuances have been severely restricted.

This systemic suppression of retail capital has prevented the channelling of billions of pounds into productive assets and delivered poor outcomes for individuals, who have generally received lower investment returns through allocation to low interest savings accounts.

The scale of both the problem and opportunity is reflected in the reduction of UK individual ownership of quoted shares from 54% in 1963 to 11% in 2022.

Despite the barriers to participation, individual investor demand has been significant when invited and there is growing appreciation of the strategic value of retail inclusion beyond the capital raise.

Demonstrated Retail Demand

- Shawbrook Group plc (2025): Significant retail demand materially scaled back to deliver c.£25m allocation to retail investors

- SSE plc (2025): Tens of millions of pounds of demand from thousands of retail investors in just hours; allocation limited by the €8m cap for undocumented secondary offerings

- UK Treasury Bills (2025): Annualised demand of over c.£1.2bn, evidencing the appetite for more attractive yield

- Royal Mail IPO (2013): 720,000 retail applicants, many first-time investors

When access is enabled, retail investors respond at scale.

Strategic Benefits of Retail Inclusion

Retail participation offers more than capital.

For Issuers and Advisers

- Incremental Demand at Strike — Retail investors provide additional demand and bring pricing tension to a bookbuild

- Favourable Characteristics — Investment platforms report that over 70% of retail investors remain holders twelve months after an IPO, indicating a long-term horizon and buy-and-hold mindset

- Diversification of Shareholder Base — Broader participation reduces concentration risk and supports governance dynamics

- Improved Liquidity and Price Discovery — Retail involvement improves trading volume, making markets more efficient and transparent, ultimately lowering the cost of equity

For Investment Platforms

- New Customer Acquisition — Primary deals consistently act as onboarding events. IPOs, corporate bonds, T-Bills and high-profile follow-ons attract new investors, often at modest cost given the issuer-funded marketing that accompanies landmark transactions

- Increased Secondary Trading Velocity — Primary transactions create multiple secondary trades as investors actively manage their position; one primary transaction can result in 3-5 further trades

- Growth in AuA — Participation in primary market deals is a catalyst to fund accounts and move assets onto platform, increasing AuA and custody fees

- Increased Customer Lifetime Value through Retention — Access to new products and investment opportunities are a catalyst to switch platform. Increased engagement through new investment opportunities encourages clients to retain cash and assets on platform

- Emphasising Brand Value and Market Leadership — Being visibly engaged in market-defining deals aligns with UK policy ambitions and elevates brand positioning

Seizing the Opportunity

The reforms effective 19 January 2026 bring transformational change and provide an exciting framework to significantly increase retail investor participation in primary markets. This bold overhaul presents a meaningful commercial opportunity, but reform of this scale requires preparation to effectively capture the benefits.

For Issuers and Advisers

The new POATRs regime provides issuers and their advisers with access to a new, material and growing pool of capital.

New Force in Capital Formation — The arbitrary €8m cap on retail allocation limited the role that individual investors could play in a fundraise. From January 19th, retail allocation has the potential to materially increase as a proportion of the overall transaction reflecting the scale and favourable characteristics of retail demand, alongside their existing position on the register.

Stakeholder Inclusion — Fundraises are an opportunity to access more than capital; technology and innovation allows issuers to enfranchise key stakeholders, such as customers, employees or suppliers through ownership.

For Investment Platforms

Regulatory change provides an exciting opportunity to engage existing and acquire new customers.

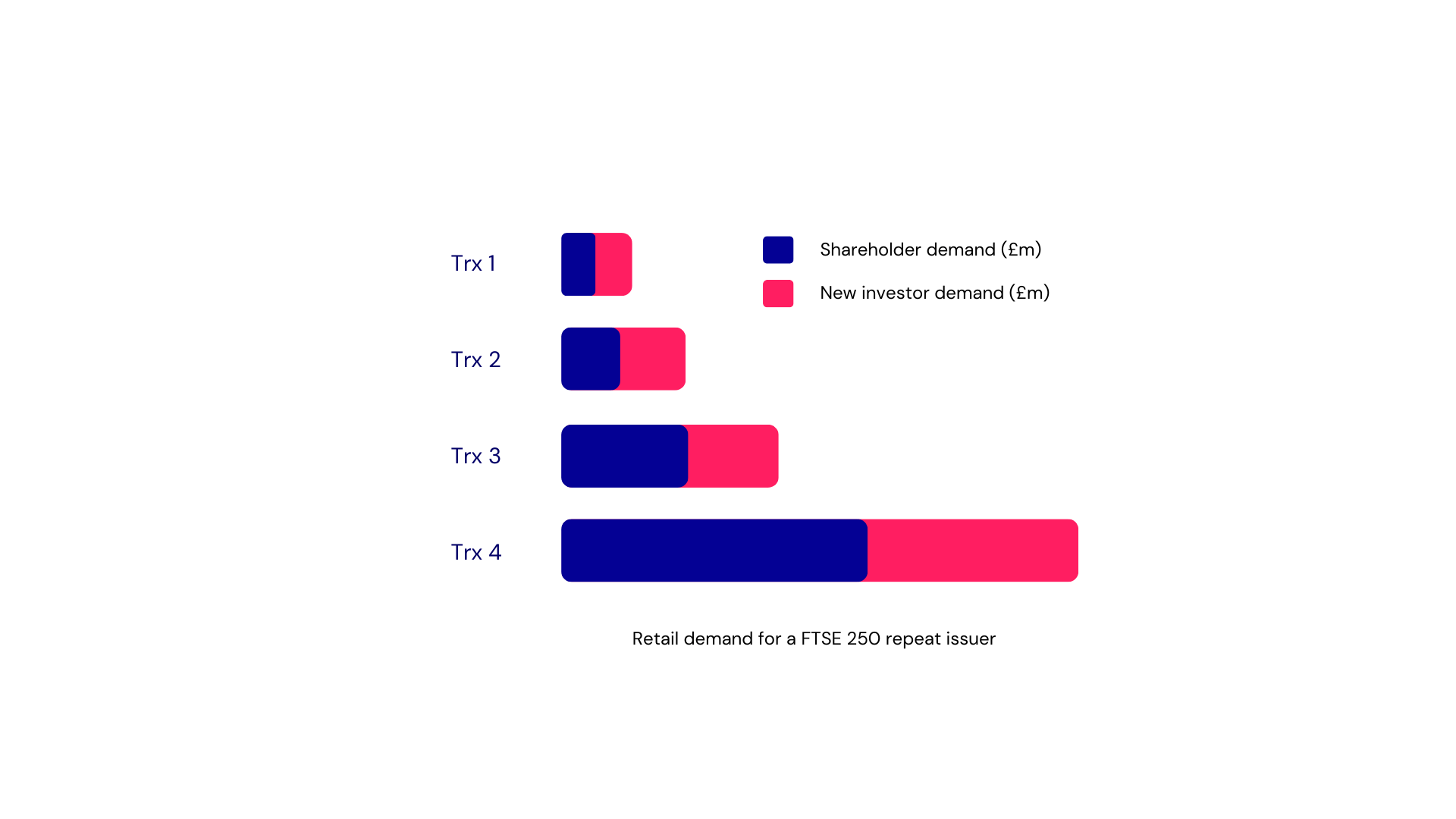

Widening Target Audience — Historically, approximately 80% of demand has been generated by new investors rather than existing shareholders on secondary offerings. Whilst soft pre-emption should be prioritised, this can be delivered at allocation rather than subscription. A clear ambition of the regulatory reforms is to increase retail ownership, and the removal of the fixed cap on retail participation allows for this to be delivered through improved allocation.

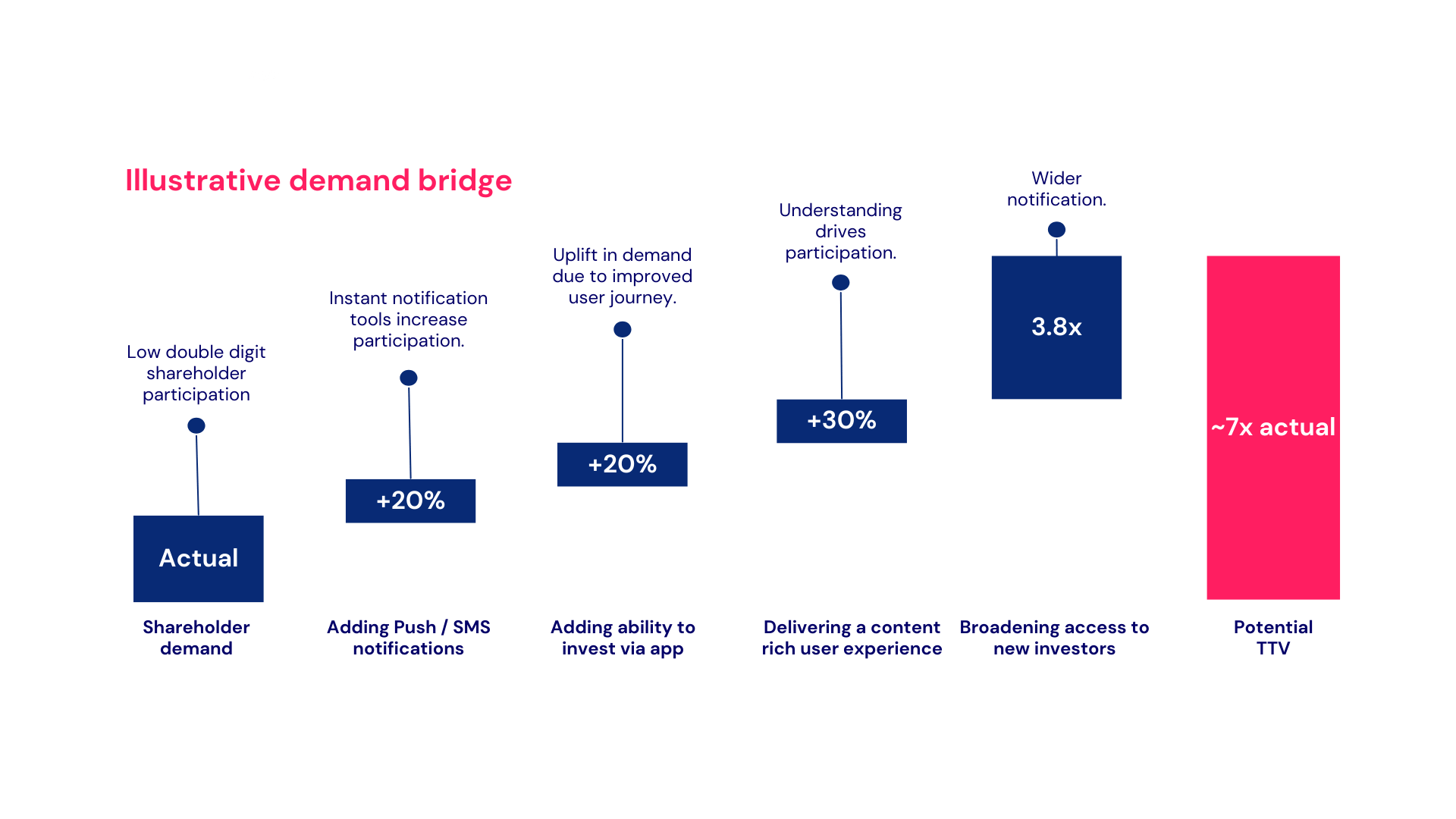

Timeliness and Visibility of Notification — Retail investors can act swiftly when notifications are delivered through effective channels. Push/SMS is much more effective than email in building awareness, especially in short duration transactions; interaction with Push notifications is 5x that of email.

Clear and Streamlined Client Journey — Access to primary market transactions via mobile increases adoption and participation; every age cohort, aside from 70+, choose to invest in App rather than via desktop or over telephone.

Provision of Educational Content — Better understanding drives participation; building foundational knowledge and an understanding of the transaction are important. Regulatory documentation targets an institutional audience and is hard to navigate; format and tone of voice is crucial. A recent survey revealed that less than 10% of retail investors know what a follow-on is, but once educated, investors are excited by the opportunity — over 80% investors would want to participate.

Transformational Change

The Public Offers and Admissions to Trading Regulations (POATRs) heralds a new era for UK capital markets. The removal of long-standing structural barriers will transform primary market access for a broad retail investor base.

For issuers and their advisers, it significantly widens the pool of available capital, providing funding for strategic projects whilst increasing liquidity and aiding price discovery.

For wealth managers, investment platforms, brokers and fintechs, this presents a compelling opportunity to attract new clients, improve client outcomes, deliver a wider range of investment opportunities and grow associated revenues.

RetailBook welcomes the opportunity to work with you to ensure your business is fully prepared for January 2026 and positioned to unlock the commercial and strategic benefits of these reforms.

Contact RetailBook team today: info@retailbook.com | www.retailbook.com

References

- FCA Policy Statement PS25/9 (July 2025)

- FSMA 2023, Public Offers & Admissions to Trading Regulations

- HM Treasury POATR regulations, 2024

- Mansion House Reform speeches and documentation

- Hill Review (UK Capital Markets)

- Secondary Capital Raising Review, 2022

- ONS “Ownership of UK quoted shares” (2022)

- FCA Financial Lives Survey 2024